The creation of regulations that allow interconnection between different national and international agencies is part of the solution to a cross-border problem such as cybercrime.

Cybercrime is one of the concerns that most surrounds the crypto market, therefore, Chainalysis shows data that leads to the conclusion that regulation is part of the solution to the problem. The Office of Foreign Assets Control (OFAC) in the United States, as well as other similar agencies in other countries, have been able to help reduce these criminal activities.

For the report on criminal activity that developed in 2022, Chainalysis took into account what has surrounded a widespread problem in the crypto world: Cybercrime.

In this globalised era, the millions of users that converge on the internet are an inexhaustible pool of possibilities for committing cybercrime. In this sense, phishing, ransomware, malware and money laundering are some of the most common crimes.

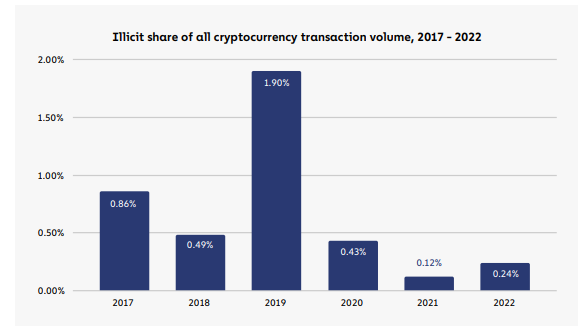

Despite this, Chainalysis data shows that criminal activity in 2022 increased by 100% during 2022, constituting more criminal activity recorded on the Blockchain.

Evolution of criminal activity on chain – Source: Chainalysis

Despite these numbers, there are also other interesting data to highlight from the report, in this case the joint action of agencies such as OFAC that have allowed blockades to be imposed on institutions, individuals or groups that engage in these criminal activities and that have been fully identified.

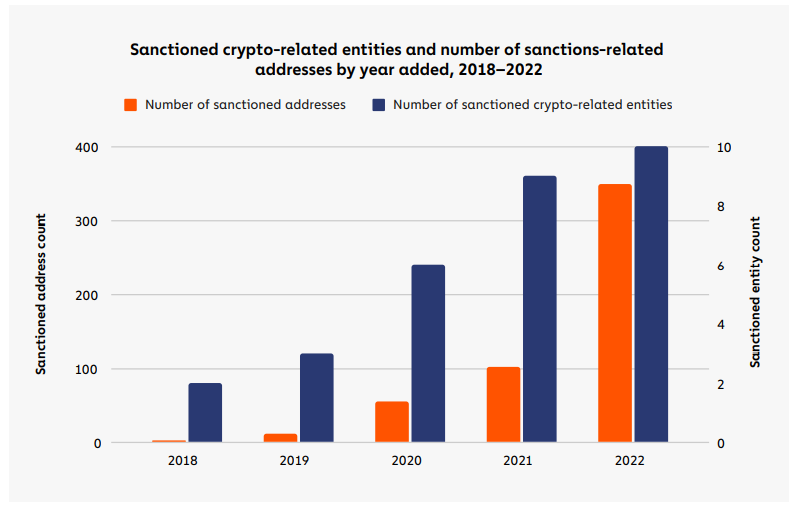

In this regard, the report shows how OFAC’s efforts have been paying off since 2018, when it first sanctioned two Iranians, who were directly linked to the SamSam ransomware. At that time, they were added to the list of blocked persons and Specially Designated Nationals (SDNs).

Since then, a number of cryptographic addresses have been part of this list, blocking the addresses associated with these individuals, which in 2018 was estimated to be two addresses per person, by 2019 about four and by 2020 about 9 per person.

Sanctioned cryptographic addresses – Source: Chainalysis

However, by 2022, it is estimated that around 35 addresses per person are used for criminal activities associated with cryptocurrencies. In addition, OFAC was able to find that in some cases, more than 100 addresses were associated with the same entity/group/person.

Specifics of how joint regulation prevents further criminal activity

The reasons for these conclusions are exemplified in three specific cases, Hydra, Garantex and Tornado Cash. The first was a platform of the deep web (or dark web) as it is known, in which illicit trade was the basis of the platform. Offering both products and services, ranging from illicit sales to money laundering through cryptographic services.

Because Hydra’s servers were located in Germany, international collaboration was possible, and so OFAC’s joint action with its counterparts in Germany was able to coordinate efforts and take over these servers, so that the dark web service ceased, and with it the cybercrime.

Second, the Garantex experience is a clear example of the problems that can arise when there is a lack of international cooperation. Despite the fact that Garantex has remained largely isolated from the compatible exchange ecosystem, Russia refused to impose sanctions against the service, allowing it to continue operating without restrictions. This situation demonstrates how difficult it is to sanction entities whose home jurisdictions do not have formal channels of cooperation with OFAC for example.

On the other hand, the case of Tornado Cash presents an even greater challenge. Although its front-end website was taken down, its smart contracts are still operational, meaning that anyone can technically use them at any time.

In this case, sanctions against decentralised services act more as a tool to disincentivise use of the service rather than to cut off use altogether. Although Tornado Cash is a blender, and blenders become less effective the less funding they receive overall, the sanctions have been effective enough to reduce its revenues by 68% in the 30 days following its designation.

These cases illustrate how OFAC and other sanctioning agencies can address sanctions designations against different types of cryptocurrency-related entities. It is important to continue to improve the ability of these agencies to effectively enforce sanctions, working in conjunction with other agencies both in the United States and internationally. As these techniques evolve, it will be interesting to see how sanctions agencies continue to adapt to changes in the cryptocurrency landscape.

Overall, illicit addresses sent nearly USD 23.8 billion in cryptocurrencies in 2022, an increase of 68% over 2021. As is often the case, major centralised exchanges were the main recipients of illicit cryptocurrencies, receiving just under half of all funds sent from illicit addresses.

That is notable, not only because these exchanges generally have enforcement measures in place to report this activity and take action against the users in question, but also because these exchanges are fiat exit ramps, where illicit cryptocurrency can be converted into cash.

Thus, with data as compelling as these, it is necessary to emphasise that uniform regulation in all countries is more than an instrument, it is a necessity, because only through these instruments can we have greater security in the actions of specialised security agencies.

To achieve greater online security, it is important to further improve cybersecurity infrastructure and technology, and to educate the general public on how to detect and avoid online threats. Greater cooperation between authorities and cybersecurity companies should also be encouraged to jointly combat online crime.

Cybercrime remains a major threat to society, and although the rate of increase is not significant, it is important not to let our guard down and to continue working together to ensure greater online security. Reality shows that cybercrime will be increasingly present in everyday life, and it is up to users, businesses and governments to combine efforts so that despite this, criminal activity in cyberspace does not continue to increase.

Source: Cointelegraph

Disclaimer: The information set out herein should not be taken as financial advice or investment recommendations. All investments and trading involve risk and it is the responsibility of each individual to do their due diligence before making any investment decision.