- Excluding the Ethereum merger, Bitcoin’s correlation with Ethereum is at its lowest point since 2021

- Bitcoin’s dominance over the entire cryptomarket rose steadily in 2023, now at a 2-year high

- Numbers say BTC could delink, regulatory crackdown changes crypto trading patterns

In recent years, it has been a fair statement to declare that most cryptocurrencies are traded as leveraged bets on Bitcoin. The world’s largest cryptocurrency goes up in value, altcoins go up some more. Bitcoin falls, altcoins fall some more. As generalisations go, it is reasonably fair.

However, within this general pattern, there have been periods when this relationship has deviated from the norm. One such moment is now, when some of the underlying numbers seem to imply that Bitcoin may be decoupling from the rest of the market.

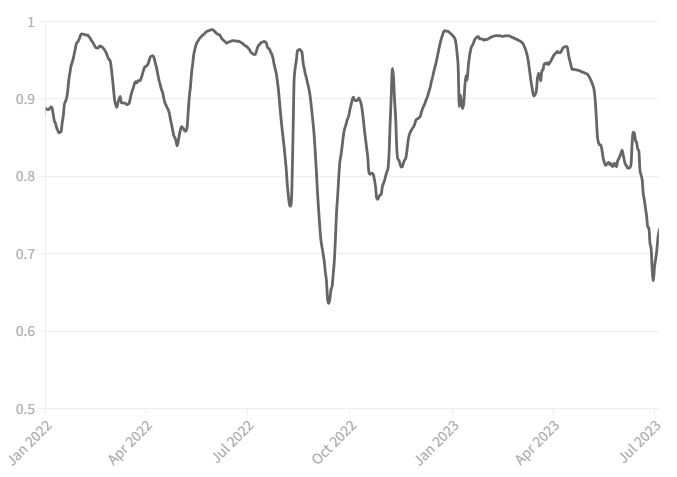

First, the most obvious way to investigate this is to plot the correlation between Bitcoin and the second largest cryptocurrency, Ethereum. The chart below shows that the normally super-high correlation has fallen to its second weakest mark in the last eighteen months, behind only September 2022, when the Ethereum merger was executed.

Ether / Bitcoin Correlation

Pearson 60-Day Correlation Coefficient

Source: @DanniiAshmore, Invezz

The Ethereum merger last September was not only an Ethereum-specific event, but the correlation almost immediately returned to normal levels. If we discount this event, you would have to go back to 2021 to see the correlation between Bitcoin and Ethereum as low as it is today. Of course, it is still not exactly “weak” at 0.7, quite the opposite, but it is remarkable in the context of the historical relationship, where the average has been a near-perfect 0.9 since early 2022.

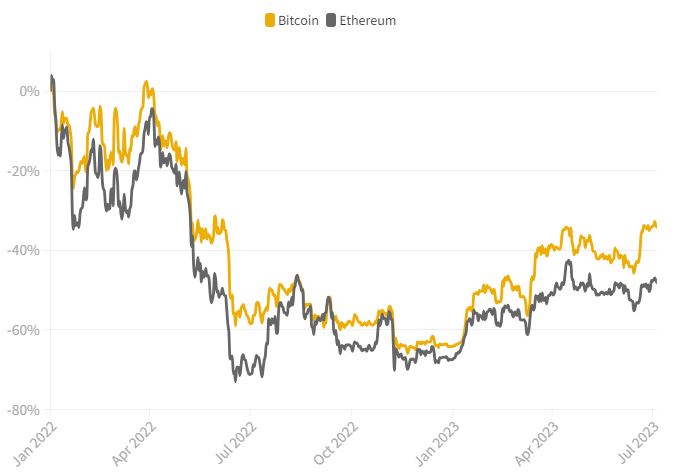

The graph shows that the correlation starts to decline around April. The next chart shows this in a different way, depicting the performance since early 2022 of Bitcoin and Ethereum. The two assets move at roughly the same time, but you can see a slight divergence emerging around April this year.

Bitcoin & Ether, Returns Since 01-Jan-2022

Source: @DanniiAshmore, Invezz

By the way, the reason I am taking the sample space from the beginning of 2022 is not strictly for a nice round number. This was when the stock market peaked and represents a transition to a new paradigm for financial markets. While interest rates only started to rise in March 2022, inflation was rising, confidence was falling and concern was close at hand, exacerbated by Russia’s invasion of Ukraine in February and the unleashing of an energy crisis. In other words, the pandemic party, also known as zero interest season, was over. It represents a structural break in the macro climate and financial markets in general.

Bitcoin went down, along with other risky assets, as rates continued to rise. But, now we ask: are we at another inflection point for Bitcoin? Why is Bitcoin’s relationship with Ethereum weakening?

Is Bitcoin carving out its own niche?

This weakening relationship has more to do with Bitcoin than Ethereum. In the chart below, we see the oft-referenced Bitcoin dominance chart, which plots the market capitalisation of Bitcoin against the market capitalisation of the entire cryptocurrency sector.

The chart shows that it has increased considerably since the beginning of 2023, jumping from 41% to 51%. That means that 51% of the total crypto market capitalisation is made up of Bitcoin, the highest mark in two years.

What is interesting is that, traditionally (if we can use that phrase in an industry that is barely a decade old), Bitcoin’s dominance falls in times of rising cryptocurrency prices. In general, Bitcoin jumps higher, before money flows into altcoins with the falling dominance ratio. This time, that is not happening.

Again, why? The answer may lie in regulation and the fact that the market increasingly sees Bitcoin as an asset that is carving out its own niche. For many cryptoheads (myself included), this has long been a point of contention. In terms of fundamentals, Bitcoin and Ethereum don’t really have much in common, except for the fact that they both run on something called the blockchain (and those two blockchains, as of the merger in September 2022, are completely different beasts).

But my point is redundant. However, the letter of the law is not; more importantly, it seems that US regulators are beginning to take the same view. As Coinbase CEO Brian Armstrong lamented after his exchange was slapped with a lawsuit last month:

We got this information from the SEC that, well, actually anything that’s not Bitcoin is a security. And we said to ourselves, well, that’s not our understanding of the law.

Brian Armstrong, CEO of Coinbase

Coinbase can complain all it wants (and it will have its day in court), but the reality for the market is that this is happening, whether it is fair or not, and it may affect the way price action in crypto moves from now on. The SEC even formally described several cryptocurrencies that it formally considered securities, including Solana, BNB and the native tokens for Cardano and Polygon. Tracing the correlation between Bitcoin and a pair of these assets as an example, the breakout is clear in June, as the market sells off in response to the confirmation of securities.

Bitcoin Correlations

Rolling 60-Day Pearson vs ADA & SOL

ADA & SOL named as securities by SEC on June 5th

Source: @DanniiAshmore, Invezz

Of course, this is a stronger sell-off and a bigger drop in correlation than what we saw previously with Ether. The world’s second largest cryptocurrency seems to be operating in a grey area, which perhaps explains why the sell-off has not been as large as, for example, ADA and SOL, but also why it is not on par with Bitcoin.

Spot ETF applications paint a brighter picture for Bitcoin

Then there is the case of spot ETF applications, coming from a handful of the world’s largest asset managers. These are Bitcoin ETFs, not Ethereum or crypto ETFs. While approval would be a boon for the cryptocurrency sector in general, as it could open the door to similar vehicles for other assets in the future, the many hurdles Bitcoin has had to evade to remain in the ETF discussion are numerous. There is still no guarantee that these ETFs will be approved; certainly, other assets seem a long way off. Therefore, the simultaneous SEC security-driven crackdown and the plethora of Bitcoin ETF applications is driving a wedge between Bitcoin and other cryptocurrencies.

The million-dollar question is whether this all goes back to normal once the furore subsides. There is no doubt that the relationship remains strong here and Bitcoin continues to lead the market. But there may also be reason to believe that there has been a structural break and that the previous hand-holding relationship will not be so close in the future.

Crypto has had a rough patch recently. The 2022 scandals were plentiful (Terra, Celsius, FTX, to name a few) and capital flight has been staggering, as (for whatever reason) investors have chosen that Treasury bills paying 5% are preferable to centralised cryptocurrencies paying -100% (hopefully -90% after many years of bankruptcy court proceedings).

While Bitcoin has also been immensely affected by the pain of 2022, its first mover advantage and lack of counterparty risk could help it avoid being tainted by the same tainted brush in the eyes of e-commerce investors. Altcoins are definitely not fashionable at the moment, and the reputation of the non-Bitcoin crypto sector has been greatly tarnished in the eyes of institutional capital.

The great Bitcoin decoupling, which would be Bitcoin cutting its correlation with risky assets and instead claiming the status of an uncorrelated store of value, seems a long way off yet. But a lesser type of decoupling, where it separates itself from other cryptocurrencies, may not be as far away as previously thought.

Once again, the numbers could immediately return to normal. Perhaps it is just a hint of what may come at some point down the road. But either way, it is one of the most crucial and intriguing trends to keep an eye on in the crypto space, even if this episode turns out to be all smoke and mirrors.

Source: invezz.com

Disclaimer: The information set out herein should not be taken as financial advice or investment recommendations. All investments and trading involve risk and it is the responsibility of each individual to do their due diligence before making any investment decision.