The crisis suffered this year is so deep that it has raised warnings of a ‘crash’ in the crypto market. The experts consulted, however, see it clearly. They have a future, but a very different one from the past.

“One year in the crypto industry is equivalent to seven in any other. The financial year that is about to end supports this recurring warning from analysts. From the crypto market’s point of view, 2022 has been the antithesis of 2021. The falls have been exceptional, and not only because of the scale of the losses. Many investors, who have not been involved in traditional markets and who jumped into digital assets in the heat of the 2021 rally, are experiencing their first market crash, a new situation that is difficult to digest.

The scale of the falls also raises the level of tension. In little more than a year, the combined capitalisation of cryptocurrencies has plummeted from the three trillion dollars it reached with the historical records of November 2021 to the current 800 billion dollars. The bursting of the bubble has volatilised more than two trillion dollars.

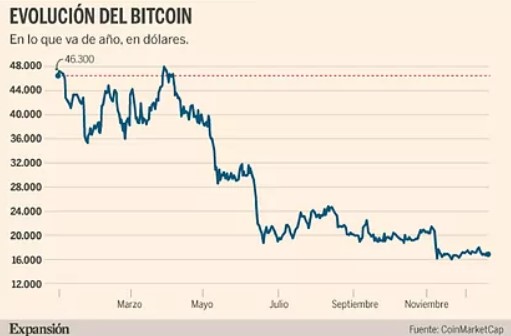

The biggest cryptocurrency, bitcoin, has plunged more than 60% with one week to go until the end of the year. And the storm has not yet dissipated. The trigger for the latest falls, the collapse of one of the world’s largest crypto platforms, FTX, is recent. Fears of a contagion of the crisis and the collapse of new companies in the crypto universe have triggered investors’ risk aversion.

Experts agree that crises such as those of FTX and the problems experienced by other entities in the sector prevent a rapid recovery of the market. On the other hand, the prolonged digestion of this crisis is creating precisely some of the necessary foundations for a future market upturn.

New investor profile

The crisis has substantially changed the average crypto investor’s profile. In the midst of the bullish rally, until November 2021, most investors jumped into the digital asset market with an eminently speculative nature, with the aim of reediting returns of three and even four digits, practically unattainable in any ‘traditional’ asset.

In little more than a year bitcoin, ethereum and the rest of the cryptocurrencies have gone from generating weekly returns of up to 100% to generating annual losses of more than 60%. This substantial change has caused a “cleansing” in the market of the most short-term profiles.

Investors, also conditioned by accumulated losses, are taking a more long-term view, and ‘withdrawing’ a record number of bitcoins from the market due to their strategy of holding on to their portfolio. Joaquín Robles, an analyst at XTB, reminds investors that “investors should not take past returns as a reference, as they were largely the result of an unjustified speculative movement”.

Regulation

The collapse in record time of one of the largest crypto trading platforms, FTX, has put to rest a long-standing debate as to whether regulation would be a threat or a necessary boost to the market. Supporters of the second option are now winning by a landslide.

From an investment perspective, Mirva Antilla, an analyst at WisdomTree, says that “it is very clear now that the industry needs to be regulated“. The same statement is echoed by crypto companies. Lukas Enzersdorfer-Konrad, Deputy CEO of the Bitpanda platform, is quick to point out that the new European regulation, MiCA, “will be the next big step in the right direction, as it will streamline regulation and supervision in the EU and hopefully mitigate some of the chaos”.

While awaiting the effects of its implementation in the future, Pablo Valverde, co-founder of the Crowmie tokenisation platform, already sees a positive impact. Regulation, he explains, “allows crypto projects to become more established in society”, “because if a government regulates them, it is in fact accepting them, in one way or another, for the future of its country”.

The upheaval resulting from crypto regulation could come sooner than expected. In 2023, with MiCA and pilot regime regulations and transpositions in each country, Marcos Carrera, Blockchain expert at consultancy firm Grant Thorton, warns that “we may go from 0 to 200 in a few weeks”.

More fraud control

The experience of what happened with FTX and the increased regulatory zeal of the authorities will in turn lead to a sifting of the market. Crises like the one experienced this year can be dramatic for investors, but as Carlos Gomez, CIO of Belobaba Crypto Asset Fund, points out, “they also bring with them a cleansing of the market of many speculative and fraudulent players”.

“The crypto community is becoming more and more educated and aware of scams, just as pyramid scams were finally extinguished when the internet appeared in 2000”, stresses Alejandro San Nicolás, Blockchain expert and professor at the International University of Valencia (VIU).

Along the same lines, Belobaba’s head of investment highlights that internal risk management controls in the crypto industry will regain a relevance that has not been so closely monitored in recent times. Carlos Gómez predicts that “the year 2023 will be positive for the ecosystem as founders and project finance funds will become more aware of the need to build solutions to real problems, and hedge funds will (hopefully) learn to implement better risk management practices by minimising excessive leverage and low diversification”.

Greater risk control and a more selective and less speculative approach by investors are two of the factors on the rise. Gerard Bernal, CEO of the cryptobank VanQ, stresses that “the future will be the immediate present if we forget about the buck and start to consider cryptocurrencies as a container that must contain valuable content“. The more speculative temptations could be overthrown, he adds, by the growing prominence of, for example, “real digital assets”, which can be “simply a stake in a larger property, such as a real estate (or set of real estate) or a private company”.

Tokenisation is one of the broad growth avenues for the industry most pointed to by experts, as is the metaverse, or decentralised finance (DeFI), a field that not only poses a threat to the traditional financial industry. It also represents a potential source of collaboration. José Luis Martínez Campuzano, spokesman for the Spanish Banking Association (AEB), suggests that, under the umbrella of a regulatory framework, a future involvement of banks “could help to improve control and risk management practices in the ecosystem and provide more confidence”.

Investment opportunity

The experts stress in particular the attractiveness and transformative potential of the crypto universe due to its multiple uses. But neither do they overlook its potential attractiveness as an investment asset, albeit under different parameters to those prevailing until the bubble burst. After the current crisis, the widespread adoption of digital assets could still take between five and seven years, according to Manuel Villegas, an analyst at Julius Baer. Nevertheless, he makes it clear that “the disruptive potential of blockchain technology has not been impacted by this year’s crisis”.

From a more investment point of view, a number of experts recently agreed on a possible floor for bitcoin at the $13,000 level, compared to the current $17,000 level.

A possible catalyst in 2023 could be the halving of bitcoin, the reduction in the pace of issuance, expected in 2024 but whose effects on price levels could be brought forward to the point of opening the door to a “new bull cycle” between 2023 and 2025, according to Alberto Gordo, co-founder of Protein Capital. To do so, it must first confirm the end of the current downward cycle.

In this macro-survey conducted by Alejandro Sánchez and published on 23 December 2022 in Expansión, the leading multichannel brand of national and international economic information on markets, investment, companies, economy, employment, legal, executives and lifestyle, one of the respondents, Herminio Fernández, our CEO of EurocoinPay®, made clear his vision of cryptocurrencies and their future.

“Cryptocurrencies are the hardest substance in the universe”

Herminio Fernández, CEO of EurocoinPay®

For twelve years cryptocurrencies have been on an incredible journey. Knowing what will happen in the next twelve years is not easy, but they will certainly prevail, says the CEO of EurocoinPay®, who lists a number of factors that dispel doubts about the future of the crypto industry. “Major players such as MasterCard are beginning to adapt cryptocurrencies, the S&P Dow Jones indices are producing reflection points for them, and the largest Wall Street firms have indicated that they will be active participants in these markets. We’ve seen institutional interest grow, the EU is betting on regulation through MiCA regulation, and the US and its regulators are on how much regulation they will apply.” For all these reasons, he says, “it is clear that cryptocurrencies are worth taking seriously”. The challenges for cryptocurrencies centre on issues such as whether they consume a lot of electricity, the speed of transactions and cybersecurity risks. Looking ahead, “cryptocurrencies that are created with cryptocurrency is the hardest substance in the universe”, and although “adoption of this technology is at 3%”, “people will at some point realise that they have more to lose by not embracing this technology than by embracing it”.

Read the full article in Expansión

Source: expansion.com

Disclaimer: The information set out herein should not be taken as financial advice or investment recommendations. All investments and trading involve risk and it is the responsibility of each individual to do their due diligence before making any investment decision.