The growing interest of financial institutions in crypto is attributed to the launch of the first spot Bitcoin ETFs in January, according to a report from PitchBook.

Venture funding for crypto-related companies totalled $1.9 billion in the fourth quarter of 2023 — a 2.5% increase from the third quarter — according to a report from PitchBook. It marks the first-time venture capital (VC) investments in crypto startups have risen since March 2022.

PitchBook highlighted that the major crypto ventures securing funding primarily center around financial and technological solutions. These include tokenizing real-world assets on the blockchain, such as real estate and stocks, and building decentralized computing infrastructure.

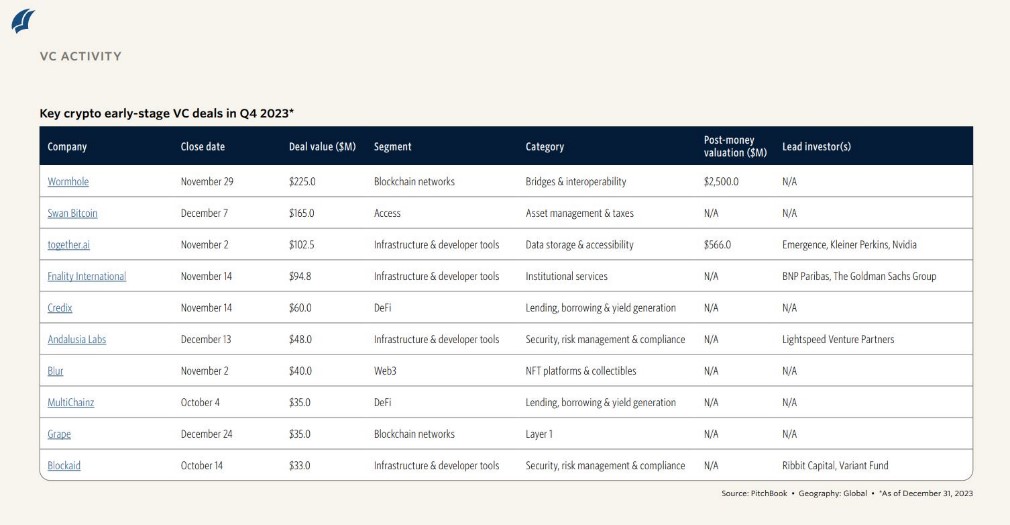

Some prominent fundraises in the quarter involved crypto exchanges Swan Bitcoin and Blockchain.com, which secured $165 million and $100 million, respectively.

Screenshot of crypto early-stage VC deals in Q4 2023.

Source: PitchBook

The most significant deal of the quarter involved a $225 million investment in Wormhole, an open-source blockchain development platform. Supported by Coinbase Ventures, Jump Trading and ParaFi Capital, the company acquired a valuation of $2.5 billion.

The increased interest in crypto from financial institutions can be attributed to the launch of the first spot Bitcoin exchange-traded funds (ETFs) in the United States in January, according to PitchBook’s report.

In the first quarter of 2023, crypto firms secured $2.6 billion in 353 investment rounds, according to PitchBook’s Q1 Crypto Report. The report showed an 11% decline in deal value from the previous quarter and a 12.2% decrease in total deals. Furthermore, the quarter marked the lowest capital investment in the space since 2020.

The crypto industry faced challenges in 2022, with market difficulties reflected in reduced venture capital funding for blockchain and crypto sectors. Following the peak at $11 billion and 692 deals in the initial four months of 2022, VC investment steadily declined in subsequent quarters.

Various factors led to decreased crypto and blockchain-related VC funding in 2022, including the collapse of the Terra ecosystem in May 2022, resulting in the bankruptcy of cryptocurrency lending firms Three Arrows Capital and Celsius.

The FTX collapse in November 2022 intensified market volatility, and broader global economic factors, such as increased interest rates and inflation, also contributed to the decline in venture capital investments.

In 2023, the crypto industry saw a turnaround, with stories of adoption worldwide and major TradFi institutions like BlackRock entering the crypto space.

Source: Cointelegraph

Disclaimer: The information set out herein should not be taken as financial advice or investment recommendations. All investments and trading involve risk and it is the responsibility of each individual to do their due diligence before making any investment decision.