- The Lower House gives the green light to the law with a large majority and a broad consensus as a result of the joint work of the Government with the sector and the rest of the political parties.

- Together with the investment programmes financed with the European Next Generation funds, the Startups Law represents the definitive boost for the Spanish ecosystem of fast-growing companies in the digital field, with high added value, innovative and with global projection.

- The Startups Law includes tax incentives, eliminates bureaucratic obstacles for the creation of and investment in technology-based start-ups, as well as encouraging the attraction of foreign talent and the return of Spaniards through, among other instruments, a streamlined procedure for granting visas.

- Spain is at the forefront of Europe with the first law focused on the creation and promotion of start-ups and the attraction of international talent and capital.

- Among the improvements included during the parliamentary process are greater incentives for serial entrepreneurship, a focus on rural entrepreneurship and specific plans to retain talent that finishes their studies in Spain.

- It is expected to come into force in January 2023.

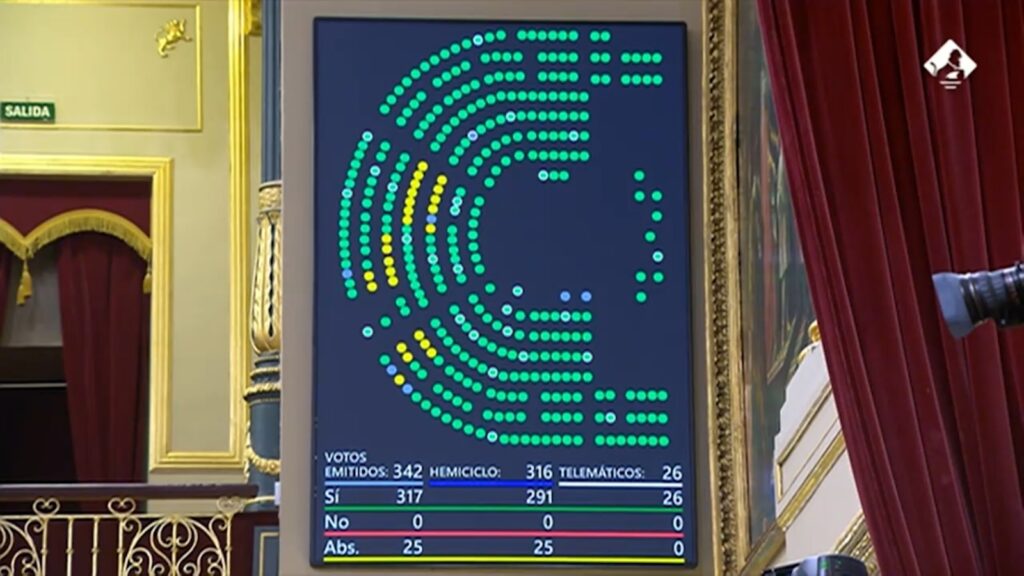

The Plenary of the Congress of Deputies has today definitively approved the Law for the Promotion of the Emerging Companies Ecosystem (better known as the Startups Law) following the incorporation of amendments from the Senate. Promoted by the Ministry of Economic Affairs and Digital Transformation, through the Secretary of State for Digitalisation and Artificial Intelligence, the law places Spain at the forefront of Europe in the development of an entrepreneurial ecosystem with an innovative vocation, as well as in the creation and growth of emerging companies and the attraction of talent and international capital.

The Startups Law is one of the major reform projects of this legislature and forms part of the policies to improve the country’s business climate, together with the Crea y Crece Law and the Bankruptcy Law, already approved this year. It is also one of the most important milestones for this year within the Recovery Plan and the Digital Spain Agenda 2026, the roadmap for the ambitious digitalisation plan that the country is carrying out.

The approval of the final text by a large majority in Congress comes after a journey of months, which began in July 2021 with the start of the public hearing process for the Draft Bill, and intense work with the different parliamentary groups and stakeholders in the sector. During this process, more than 80 amendments submitted by the parties have been incorporated with the aim of improving the initial text and strengthening the consensus around it.

Some of the improvements included during the parliamentary process and the passage through the Senate are the following:

- Greater incentives for “serial” entrepreneurship are contemplated. The founding partners of start-ups embarking on new projects will be able to benefit unlimitedly from the benefits of the Law.

- Rural entrepreneurship is boosted, launching pilot projects in rural environments and aligning the initiatives envisaged in the Law with the Intelligent Rural Territory, a project that envisages the incorporation of new technologies in areas such as agriculture, livestock, urban planning and the environment in villages.

- The requirements are made more flexible and the possibility of retaining talent that completes their studies to seek employment in Spain is incorporated.

- A special Digital Nomad visa is created for holders who work for themselves or for employers anywhere in the world in national territory.

Main axes to boost the entrepreneurial fabric

With the Startups Law, the Government seeks to stimulate investment and attract talent, encourage collaboration between SMEs, large companies and start-ups, promote R&D&I, also in the Administration, and foster cooperation between start-ups and entrepreneurs and universities and research centres.

The regulation defines the category of start-up company as one that is no more than 5 years old (or 7 for strategic sectors); that is not listed on the stock exchange and does not distribute dividends; whose headquarters or registered office is permanently established in Spain; with 60% of the workforce employed in Spain; and that accumulates a maximum turnover of 10 million euros.

It must also accredit “innovative character”, understood as the development of new or improved products or services. To this end, seven lines of criteria have been incorporated to be assessed by the National Innovation Company (ENISA), including the “degree of innovation”, “degree of market attractiveness”, “phase of the company’s life”, “business model-scalability”, “competition” and “volume of customers”.

The main objective of the Law is to promote administrative flexibility, for which it provides for a one-stop, telematic window managed by ENISA for the certification of innovative companies as Spanish start-ups; the non-obligatory requirement to obtain a foreigner’s identification number (NIE) for non-resident investors, requiring only tax identification numbers (NIF) for them and their representatives; and the minimum cost of notary and registry fees.

The text incorporates important tax measures, such as the reduction of the tax rate on corporate income tax and non-resident income tax, from the general rate of 25% to 15% in the first four years after the tax base is positive. Or the increase in the amount of the exemption from taxation of stock options from 12,000 to 50,000 euros per year in the case of delivery by start-ups of shares or participations derived from the exercise of purchase options.

In addition, it also increases the maximum deduction base for investment in new or recently created companies (from 60,000 to 100,000 euros per year), the deduction rate (from 30% to 50%), as well as the period in which it is considered recently created, which increases from 3 to 5 years, in general, or to 7 years for companies in certain sectors.

The attraction, retention and return of national and international talent is another pillar of the Law. For this reason, it envisages visa and residency facilities for highly qualified start-up workers, as well as for non-resident Spanish workers for at least 5 years.

It also seeks to improve the regulatory framework through test environments and sandboxes. In this sense, it will allow start-ups to test their innovation for one year, in a controlled environment, in order to assess the usefulness, viability and impact of technological innovations in the different sectors of productive activity.

Leading Europe

The Startups Law is the first law specifically aimed at creating an innovative entrepreneurial ecosystem in Europe.

It complements and reinforces the impact of investments financed with Next Generation funds, such as ENISA’s programme to support startups led by women or ICO’s Next Tech fund to scale innovative companies in disruptive technologies.

Spain already has an entrepreneurial ecosystem of 10,000 companies, with 140,000 workers in a growing number of poles of attraction in the territory, and a market value that has multiplied by 20 in the last 10 years.

In recent years, its entrepreneurial ecosystem has established itself in the TOP 20 worldwide, above the European average (GEM 20-21), and ranks fourth among European startup ecosystems. In recent years, it has strengthened its leadership in this field, positioning itself as a hub for digital talent in the EU and being one of the founding countries of the ESNA (European Startup Nation Alliance) together with Austria and Portugal. This alliance is aimed at generating a coordinated digital entrepreneurship ecosystem in Europe, with the goal of doubling the number of technological unicorns in the EU by 2030. This is a large-scale challenge in which Spain is establishing its leadership thanks to initiatives such as the recently approved regulation.

After its final approval in Congress, the Startups Law is expected to come into force at the beginning of 2023.

DOCUMENT

View press release (PDF – 283 KB)

Disclaimer: The information set out herein should not be taken as financial advice or investment recommendations. All investments and trading involve risk and it is the responsibility of each individual to do their due diligence before making any investment decision.

Source: portal.mineco.gob.es